Below we cover the best options for grants and where you can apply. Also we will go over the current loan status for students in the country and what you can do to make your loan experience better.

Finding and Applying for Healthcare Education Grants

The percentage of grant dollars going to the lowest income students is about 42%. With all that said it is simple, apply for as many grants and scholarships as possible. Develop a process for applying and do your research. The worst that can happen is they say no. And most often that is in an email. So you have nothing to lose. All it take is a little time and some writing.

When and How do I Apply for Grants

Federal and state governments give college grants to students and are readily available to apply for. The first thing you will have to fill out is the Free Application for Federal Student Aid (FAFSA). This application starts the process of determining how much financial aid you will qualify for. These applications are available at the offices at every school and college in the country and online here.

After you fill out your FAFSA application, you will then begin to get financial aid award letters from the colleges that accepted you for school. Grants are always first come first serve so the faster you get started the better!

Sallie Mae Grants

Federal Pell Grants – The single largest source of federally funded grants are Federal Pell Grants. They given out based on your individual financial need only.

Teach Grants – Grants for individuals who choose to teach for four years at an elementary school, secondary school, or educational service agency serving students specifically from low-income families.

Federal Supplemental Education Opportunity Grants – FSEO Grants are to assist low-income undergrad students in paying for their education.

Iraq and Afghanistan Service Grants – These grants are specifically for students who had a parent or guardian die as a result of their military service after September 11, 2001, in either Iraq or Afghanistan.

Click here for more information from Sallie Mae.

HRSA Government Healthcare Grants

The Health Resources and Services Administration have many grants that they offer and are considered a leader in government grants. We will highlight their grants below. Feel free to follow the links to the individual grant description page.

Health Careers – Grants that specific to careers in within healthcare.

Medicine Grants – Grants that specific to careers in within medicine.

Nursing Grants – Grants that specific to careers in within the field of nursing.

Public Health Grants – Grants that specific to careers in within public health sector.

Oral Health Grants – Grants that specific to careers in within field of oral health.

Behavioral Health Grants – Grants that specific to careers in within behavioral health.

Geriatrics – Grants that specific to careers in within field of geriatrics.

C.R. Bard Inc. Grants

According to the Bard website their mission statement is as follows below:

Bard is committed to supporting the training and education of healthcare professionals under the guidance of ACCME and the AdvaMed Code of Ethics. For more information on these guidelines please visit: advamed.org and accme.org. For a full description of their application process click here.

Lily Grants

According to the Lilly website they provide grants and charitable contributions for healthcare professional education, patient advocacy and consumer education programs in a variety of areas. Here is a link to their grant application page.

Partners in Information Access for the Public Health Workforce Grants

The partners for information access for public health workforce is a collaboration of different U.S. government agencies, public health organizations and health sciences libraries. Here is a link to all of their different grants that they offer and links to their applications.

What you can do to Limit Student Loan Debt

We are going to cover how we can limit that debt for those who want to attend healthcare schools and options to so just that.

Using grant options can be the best thing you ever did if you take the time to apply for as many grants that you may apply for. When in doubt, APPLY for GRANTS! Scholarships and grants are the only two options for funding for school that do ad to your debt! So it is in your best interest to try and apply to as many grants that you qualify for.

Other Ways to Lower Student Loans Debt

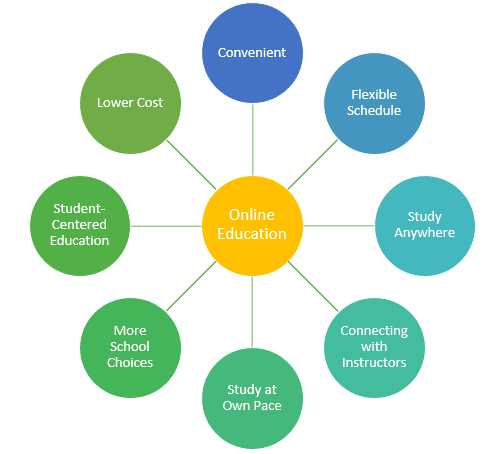

The feeling student loans give is that they are inevitable if you are not an athlete or valedictorian at your school scholarships are out of the question and grants are this mysterious thing that nobody gets. We try to dispel that above but there is another way to reduce school cost which in turn, will lower student debt. That is online classes. The average online class is much cheaper that a traditional campus education. In every situation it is cheaper for the school and for the student.